Earning The Multiple

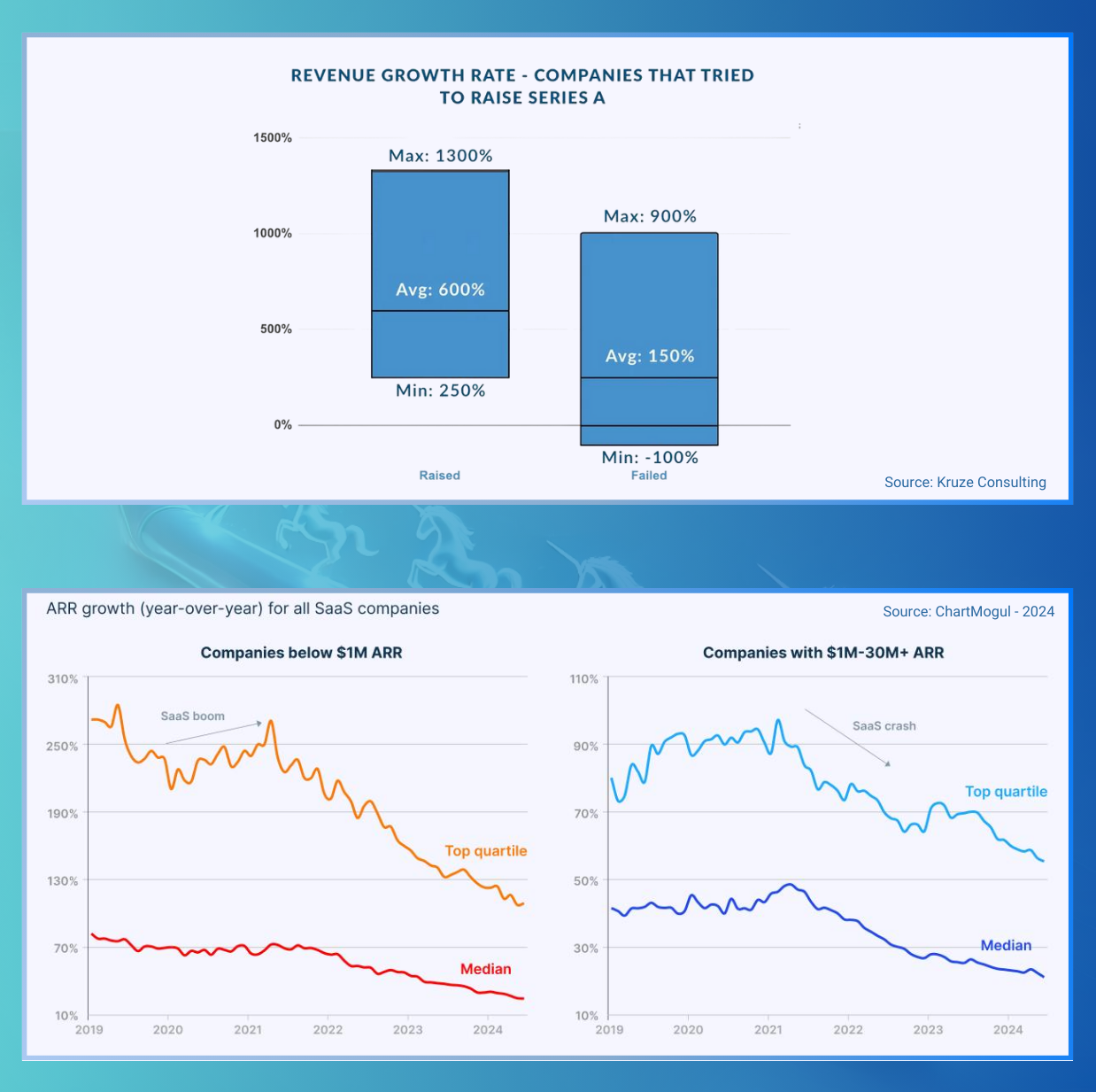

Most SaaS business plans assume growth will solve for everything—but ignore the reality that growth decays over time. With Growth Endurance now averaging just 65%, and public markets rewarding EBITDA over hype, operational efficiency is no longer optional. This article explores why companies must optimize early, scale deliberately, and treat discipline as a core driver of enterprise value. In today’s market, it’s not enough to grow—you have to grow well.

The New Stable of Dollars

The next fintech boom may not be built on legacy bank partnerships or complex regulatory workarounds—it could be built directly on stablecoins. By removing cross-border friction, reducing intermediaries, and enabling instant, programmable financial flows, offer a foundation for a new class of fintech startups.

AI Meets The Family Back Office

Despite managing $2.4T in assets, many family offices still rely on manual processes. Tech-enabled services that streamline financial administration, accounting, and reporting offer massive potential, especially when paired with human oversight and trust.

Underwriting discipline, the key to specialty finance

Fintech specialty finance originators (FSFO) need equity investors who balance growth and profitability, focusing on capital efficiency, cash flow, and sustainable unit economics. Disciplined FSFOs can achieve premium valuations, delivering strong, risk-adjusted returns for shareholders over time.

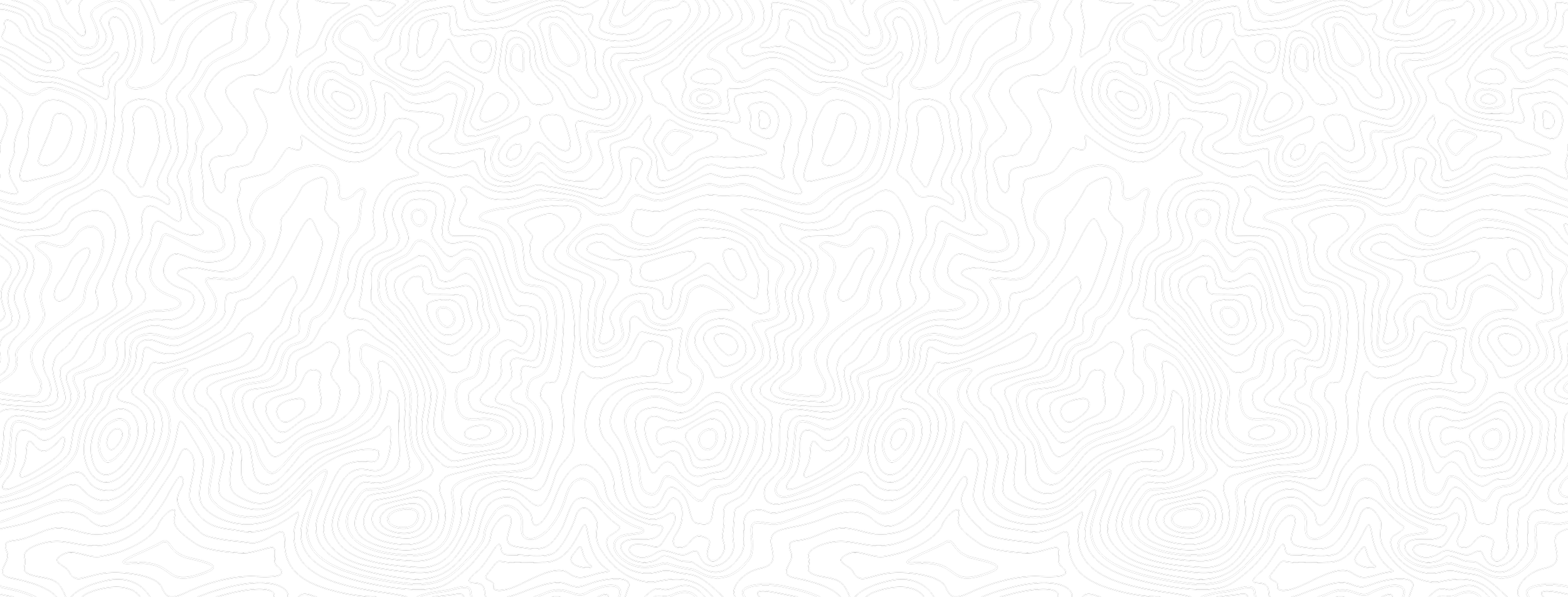

Chasing Hypergrowth? You Might Be Missing the Best Investments

While startup cohorts has kept growing, unicorn rates are declining. Despite rising valuations, hypergrowth expectations outpace actual startup growth (30–60%). With 10,000+ funds competing, capital concentrates in top-tier startups, sidelining solid but slower-growing businesses. To unlock value, investors must support sustainable growth.

Does strategic money win better?

Financial technology (Fintech) startup executives and their boards should consider engaging corporate investors as an alternative way to leapfrog competition. The right CVC can provide tangible strategic augmentation through early commercial endorsement and referenceability, while creating implicit downside protection.