Earning The Multiple

Most SaaS business plans assume growth will solve for everything—but ignore the reality that growth decays over time. With Growth Endurance now averaging just 65%, and public markets rewarding EBITDA over hype, operational efficiency is no longer optional. This article explores why companies must optimize early, scale deliberately, and treat discipline as a core driver of enterprise value. In today’s market, it’s not enough to grow—you have to grow well.

The New Stable of Dollars

The next fintech boom may not be built on legacy bank partnerships or complex regulatory workarounds—it could be built directly on stablecoins. By removing cross-border friction, reducing intermediaries, and enabling instant, programmable financial flows, offer a foundation for a new class of fintech startups.

AI Meets The Family Back Office

Despite managing $2.4T in assets, many family offices still rely on manual processes. Tech-enabled services that streamline financial administration, accounting, and reporting offer massive potential, especially when paired with human oversight and trust.

Underwriting discipline, the key to specialty finance

Fintech specialty finance originators (FSFO) need equity investors who balance growth and profitability, focusing on capital efficiency, cash flow, and sustainable unit economics. Disciplined FSFOs can achieve premium valuations, delivering strong, risk-adjusted returns for shareholders over time.

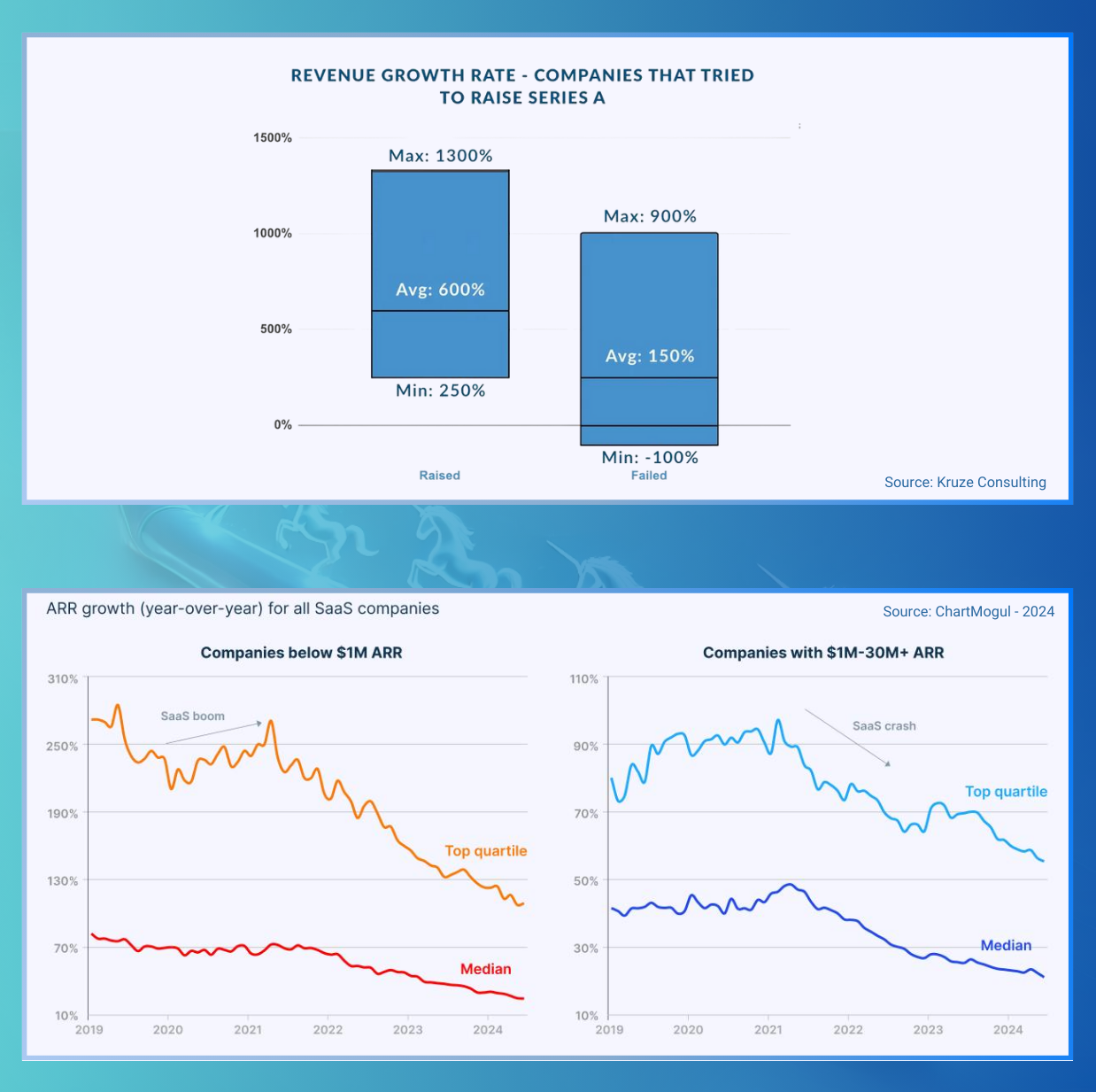

Chasing Hypergrowth? You Might Be Missing the Best Investments

While startup cohorts has kept growing, unicorn rates are declining. Despite rising valuations, hypergrowth expectations outpace actual startup growth (30–60%). With 10,000+ funds competing, capital concentrates in top-tier startups, sidelining solid but slower-growing businesses. To unlock value, investors must support sustainable growth.

When it's not primary, is it secondary?

VCs remain cautious but selectively optimistic amidst a backdrop of economic adjustments. Investors are showing a growing appetite for alternative liquidity options such as secondaries. Structured growth equity strategies could offer diversification into a less volatile asset class while also supporting the startup and VC ecosystem.

Is venture liquidity in stagnant waters?

Structured growth equity strategies could be a solution to the current venture illiquidity overhang by providing founders the capital and operational assistance to continue building, giving investors access to a long-term structural opportunity, and making the startup ecosystem stronger.

When it’s low, how can it bounce back?

Founders and investors should consider alternatives for startups that don't exhibit the potential for IPOs or fund-returning outcomes. Structured growth equity strategies could keep mid-stage startups in business by injecting capital and recalibrating their operations until their economics, not just market, bounces back.

Can founders get a second bite at the apple?

Most startups, in Fintech and beyond, are meant to be steady businesses with product market fit, loyal customers and robust growth. For founders who won't achieve a venture scale outcome, structured growth equity is a viable financing solution that combines capital with operational expertise, and preserves significant upside for founders.

Is AI eating the venture world?

AI success and adoption happen when tied to novel use cases that drive higher efficiency and better user experiences. For Fintech, companies’ transformation requires new structured growth equity investments and the support of experts who can marry capital with operational expertise.

When clouds are low, who keeps flying?

Alongside stronger M&A and buyout exit trends, structured growth equity strategies could offer investors better liquidity options and keep challenged startups flying at revised altitude.

If it’s locked, can you unlock it?

With large amounts of capital locked in traditional investment funds, institutional investors and limited partners (LPs) might start exploring new asset classes and strategies.

Is borrowing capital the same as borrowing time?

Startup founders should carefully consider funding options. Not as a temporary relief but in the long run.

Are VC externalities creating new opportunities?

Most venture-backed businesses are hard to time, conceptually unproven or operationally frail from inception, and naturally end up failing. Very few emerge as market disruptors and winner-take-all outcomes. But what about the middle cohort? These businesses, with great founders, dedicated teams and product expertise can thrive with venture buyouts: a financial partnership and operator-led approach that offers founders a second shot at success.

Pack up or buckle up?

Venture capital model is well-suited for businesses with exponential growth patterns. For many startups, a steady 15-20% annual growth rate is a more realistic and sustainable goal. Founders can still realize strong economic success when partnered with the right investors. Venture buyouts offer a viable alternative, bridging the gap between traditional venture capital and private equity firms.

What’s left for founders when investors move on?

Drastic recaps can have a major impact on equity and future upside for Fintech founders. Venture buyouts help recognize and reward the true worth of their businesses, giving founders a renewed opportunity to realize value.

Are the lines blurring between VC and PE?

Buyouts are increasing as an exit option for VC-backed companies. From 2006-2011, they accounted for less than 10% of exits but rose to 20% by 2018. VC-backed buyouts grew 46% YoY in 2021.